Gold Price Vs Inflation Chart Uk

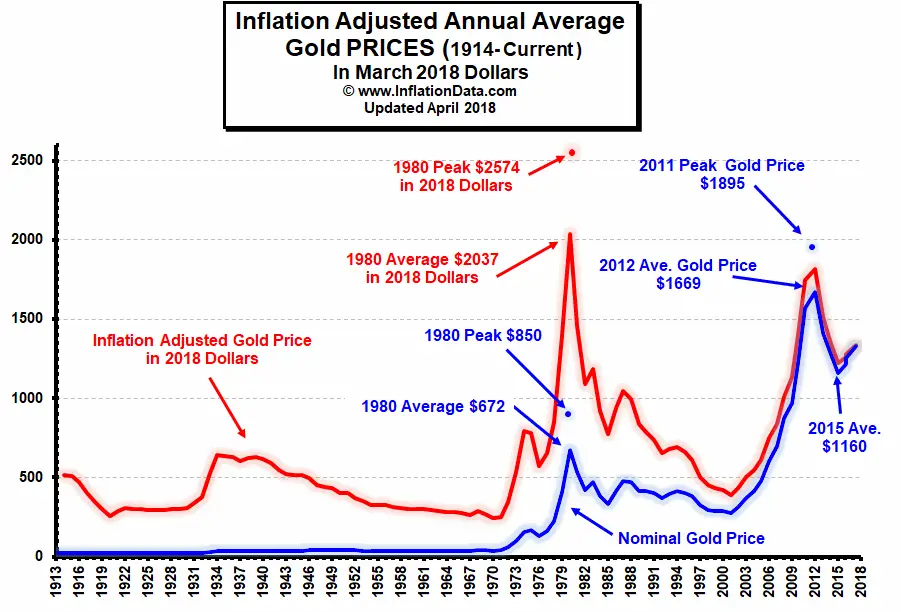

Interactive chart of historical data for real inflation adjusted gold prices per ounce back to 1915.

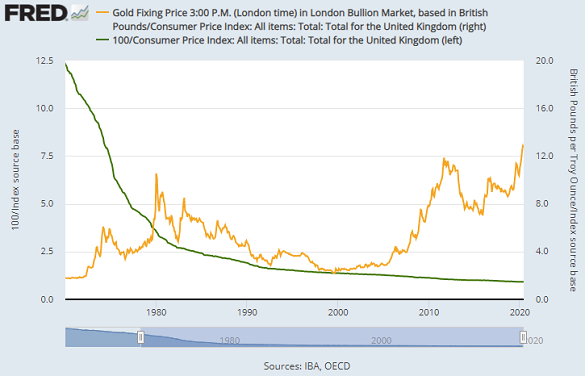

Gold price vs inflation chart uk. The current month is updated on an hourly basis with today s latest value. Weekly avg gold not seasonally adjusted nominal data. In order to show monetary inflation m2 is divided by gdp gross.

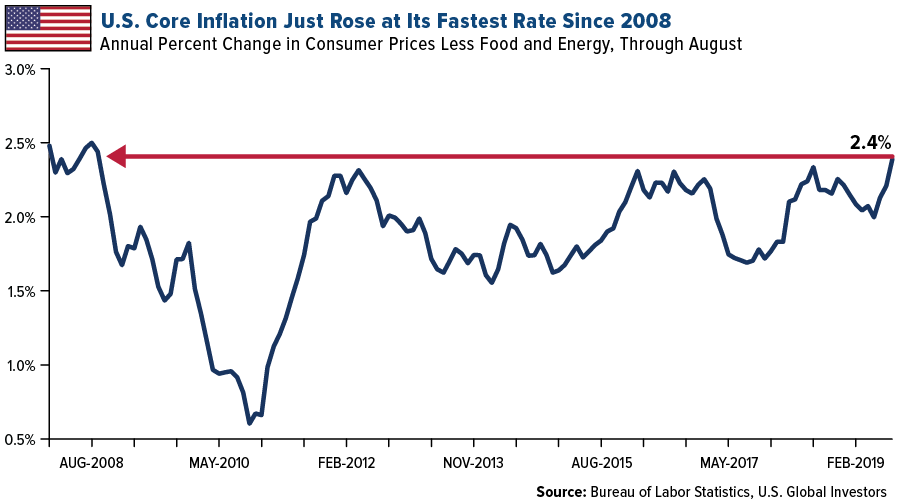

The conclusion from this chart is the 5 year tips and the real gold prices aren t correlated. In 1980 the price of gold peaked and the annual inflation rate declined but cumulative inflation climbed steadily upward. The relationship here is very loose and thus is not acceptable.

As we bring the gold price into the picture the following chart is offered. At the time of writing gold s rate against the usd is around 1 390 and has been strongly influenced by the fed s recent comments regarding potential. View the live gold price updated every 5 seconds for the most accurate gold charts in the uk.

Use the toggles below the chart to zoom in on a particular period of time of interest. As we can see from the chart above in 1980 cumulative inflation since 1913 was 780 and by the year 2000 cumulative inflation was 1675. Since then the gold price has increased only 125.

Gold price last 10 years. Gold prices 100 year historical chart. The chart shows the price peaked in september 2011 following 10 years of straight year on year gains.

Because gold is considered a hedge against inflation many investors decide to buy gold to protect their capital against value erosion which arises from an increase in general prices. Real inflation vs real interest rates vs gold price. Probably a better reference point for the market top is the average price during 1980 as a whole.